So, you’re dreaming of retiring in 10 years and living that sweet $300,000 annual income lifestyle, huh?

Sounds like a plan! But here’s the million-dollar question: How much do you need to invest right now to make that dream a reality?

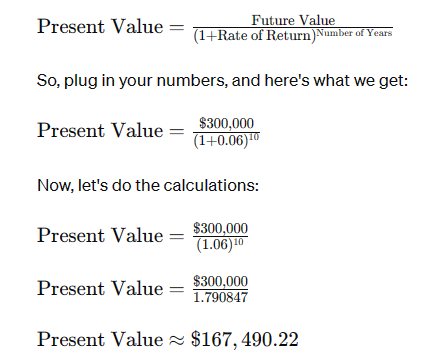

Let’s crunch some numbers. With an expected rate of return of 6% annually (it’s very common rate of guaranteed / conservative return in commercial real estate. Read: apartment buildings, NNN), we’ve got some math to do. Now, I’m no mathematician, but luckily, there’s a nifty formula for this kind of thing)):

Let’s plug in our numbers, and here’s what we get:

So, there you have it! To secure that sweet $300,000 annual income in 10 years with a 6% rate of return, you’d need to invest approximately $167,490.22 today. Not too shabby, huh?

Now, I’m not saying it’ll be easy – it’ll take some serious dedication and smart investing to make it happen. But with a solid plan and a little number-crunching, you’ll be well on your way to retirement bliss in no time.

Hope that helps!

Retiring in 10 years is an ambitious but achievable goal with careful financial planning! By understanding the key components of the computation outlined above, you can take confident steps towards a financially secure retirement. While we can’t guarantee any particular outcome, five consecutive cycles doubling investor money with each cycle could potentially yield the outcome described above.

Remember, it’s never too early to start planning for the future, and the right investments can make all the difference.